The Adjusted Trial Balance for Happy Company Follows

Happ Capital 62288 302 E. Complete the work shedocx from ACCT ACCOUNTS R at Blue Nile University.

Solved The Adjusted Trial Balance For Happ Company Follows Chegg Com

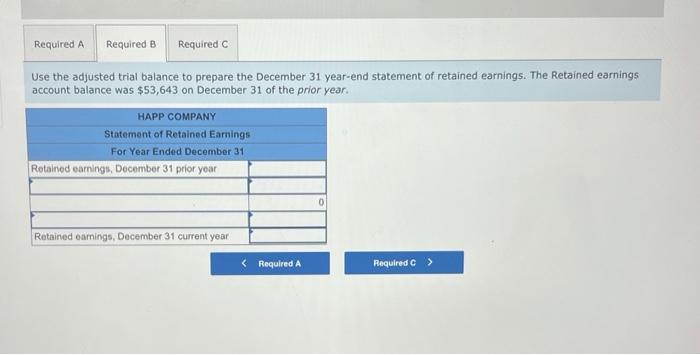

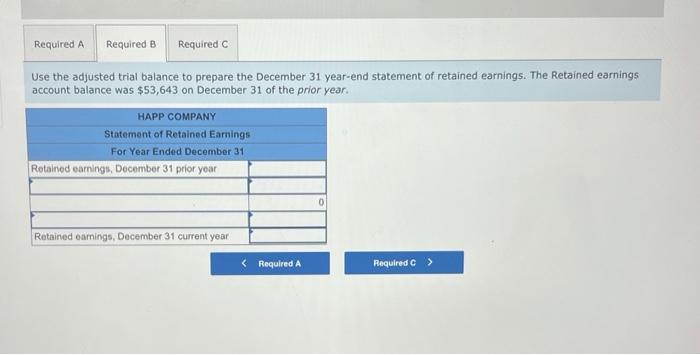

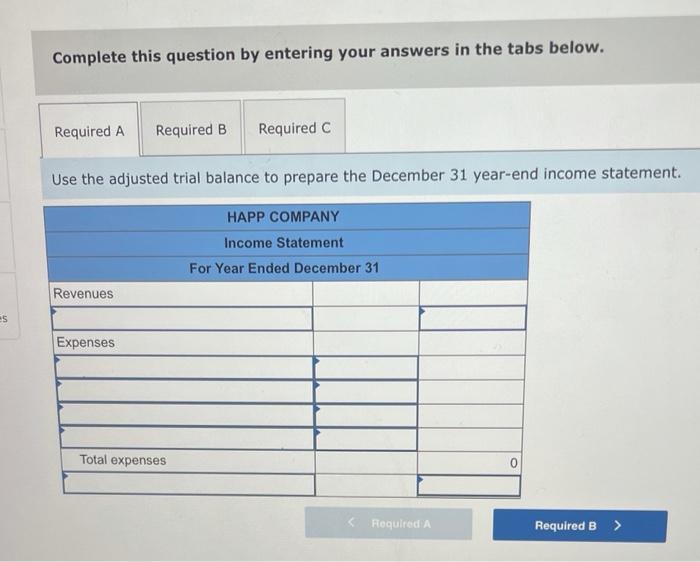

Required A Required B Required Use the adjusted trial balance to prepare the December 31 year-end Income statement HAPP COMPANY Income Statement For Year Ended December 31 Revenues Expenses Total expenses RA Required med The adjusted trial balance for Happ Company follows.

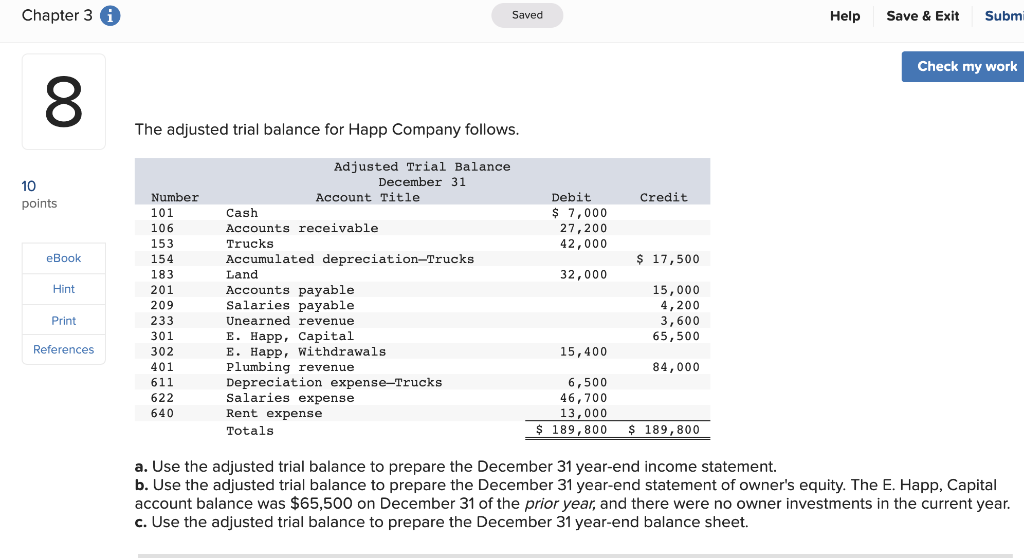

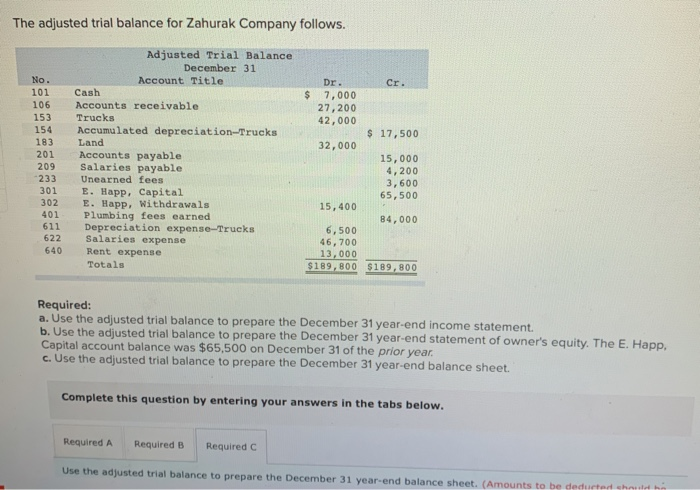

. Prepare a balance sheet as of. A the income statement for the year ended December 31. Os Adjusted Trial Balance December 31 Number Account Title Debit 101 Cash Credit 106 7000 Accounts receivable 153 27200 Trucks 154 Accumulated depreciation-Trucks 42000 183 Land 17500 201 Accounts payable 32000 209 Salaries payable 15000 233 Unearned revenue 4200 301 3600 E.

Complete the work sheet by extending the account balances into the appropriate financial statement columns and by entering the amount of net income for the reporting period. Waterstone Capital 11400 T. Assume Smith Sign Company has a January 31 year-end.

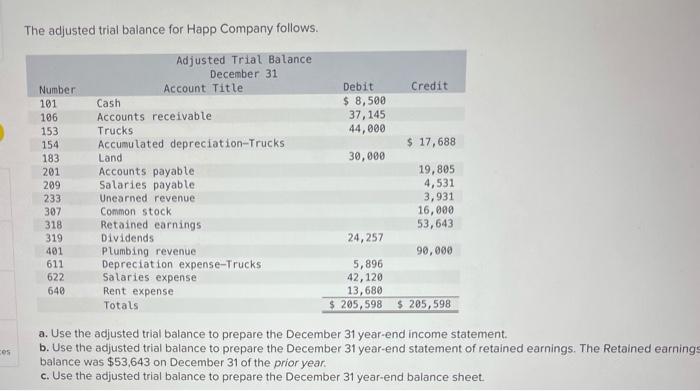

The adjusted trial balance for Happ Company follows. Question The allowance method based on the idea that a given percent of a companys credit sales for the period is uncollectable is. Adjusted Trial Balance December 31 Number Account Title Debit Credit 101 Cash 8500 106 Accounts receivable 37 145 153 Trucks 44000 154 Accumulated depreciation-Trucks 17688 183 Land 30000 201 Accounts payable 19805 209 Salaries payable 4531 233 Unearned revenue 3931 307 Common stock 16000 318.

The adjusted trial balance for Zahurak Company follows. Nguyen are as follows. Journalize smiths closing entries at January 31.

Waterstone Capital 11400 T. Adjusted Trial Balance December 31 Number Account Title Debit Credit 101 Cash 7000 106 Accounts receivable 27200 153 Trucks 42000 154 Accumulated depreciationTrucks 17500 183 Land 32000 201 Accounts payable 15000 209 Salaries. How much net income or net loss did Smith earn for the year ended January 31.

Prepare an income statement owners equity statement and a classified statement of financial position. Use the information in the adjusted trial balance to prepare. The adjusted trial balance is prepared after all adjusting entries have been Journalized and posted.

The adjusted trial balance for Happ Company follows. B the statement of retained earnings for the year ended December 31 Note. Cash 8000 Prepaid insurance 2400 Equipment 18000 Accumulated depreciationEquipment 3600 Salaries payable 2000 Unearned repair fees 1200 T.

Credit Debit 4700 20539 40000 16080 30000 Number 101 106 153 154 183 201 209 233 307 318 319 401 611 622 640 Adjusted Trial Balance December 31 Account Title Cash Accounts receivable Trucks Accumulated depreciation-Trucks Land Accounts payable Salaries payable Unearned revenue Common stock. 101 Cash 5400 106 Accounts receivable 23598 153 Trucks 40500 154 Accumulated depreciationTrucks 16281 183 Land 30000 201 Accounts payable 12582 209 Salaries payable 2878 233 Unearned fees 2278 301 E. The Adjusted Trial Balance for Planta Company follows.

Credit Debit 4 100 17 917 43 500 17487 30000 Number 101 106 153 154 183 201 209 233 301 302 401 611 622 640 Adjusted Trial Balance December 31 Account Title Cash Accounts receivable Trucks Accumulated depreciation-Trucks Land Accounts payable Salaries payable Unearned revenue E. The adjusted trial balance of Smith Sign Company follows. The adjusted trial balance for Happ Company follows.

The adjusted trial balance for Happ Company follows. Totals 1254800 1254800. Waterstone Company Adjusted Trial Balance December 31 Debit Credit Cash 8000 Prepaid insurance 2400 Equipment 18000 Accumulated depreciationEquipment 3600 Salaries payable 2000 Unearned repair fees 1200 T.

STONE SIGN COMPANY Adjusted Trial Balance January 31 2018 Balance Account Title Credit Debit 15400 Cash Office Supplies 1500 Prepaid Rent 1400 Equipment 60000 7000 Accumulated Depreciation-Equipment Accounts Payable 3800 Salaries Payable 100 Unearned Revenue 4200 Notes Payable long-term 4300 Common Stock 48800 Dividends 800 Service. Question The Akron Slugger Company produces various types of wooden baseball bats. The adjusted trial balance for Happ Company follows.

The Adjusted Trial Balance for. Adjusted Trial Balance December 31 No. The adjusted trial balance for Happ Company follows.

174 The adjusted trial balance of the Waterstone Company follows. Complete the worksheet by extending the balances to the financial statement columns. It has calculated the average cost per unit of a production level of 7500.

View The Adjusted Trial Balance for Company follows. C the balance sheet as of December 31. The adjusted trial balance for Indy Furniture Company on November 30 the end of its first month.

Prepare a statement of cost of goods manufactured for the month of November2. SMITH SIGN COMPANY Adjusted Trial Balance January 31 2016 Balance Debit 15300 1800 1000 51000 Account Title Cash Office Supplies Prepaid Rent Equipment Accumulated Depreciation- Equipment Accounts Payable Salaries Payable Unearned Revenue Notes Payable long-term Common Stock Dividends Service Revenue Salaries Expense Rent Expense. Waterstone Withdrawals 4000 Repair fees.

The adjusted trial balance of the Waterstone Company follows. Adjusted Trial Balance is a list that contains all the accounts and their balances after adjustments have been made is called adjusted trial balance. The adjusted trial balance columns of the worksheet for Nguyen Company owned by C.

Credit Debit 8700 38019 41000 16 482 30000 Number 101 106 153 154 183 201 209 233 307 318 319 401 611 622 640 Adjusted Trial Balance December 31 Account Title Cash Accounts receivable Trucks Accumulated depreciation-Trucks Land Accounts payable Salaries payable Unearned revenue Common stock. How can you tell. Retained Earnings at December 31 of the prior year was 257220.

Prepare an income statement for the month of November3. Adjusted Trial Balance December 31 Account Title Debit Credit 101 Cash. The adjusted trial balance shows the balances of all accounts including those that have been adjusted at the end of the accounting.

67 7 Miscellaneous expenses 8700 8700 Totals 189800 189800 6620 0 8400 0 10800 0 10580 0 Net Income 2200 2200.

Solved The Adjusted Trial Balance For Happ Company Follows Chegg Com

Solved The Adjusted Trial Balance For Happ Company Follows Chegg Com

Solved The Adjusted Trial Balance For Zahurak Company Chegg Com

Solved The Adjusted Trial Balance For Happ Company Follows Chegg Com

Comments

Post a Comment